Hundi Crime and Court Process in Nepal

Hundi Crime and Court Process in Nepal

This article describes detailed information on hundi crime and associated court process for this crime in Nepal.

01. Background:

Hundi is an informal, trust-based money transfer system where agents exchange cash locally without physical movement or official records. Elements for Hundi Crime:

This legal article regarding hundi focusses on what Hundi Crime are? It’s Law and Case Proceedings in Nepal.

02. Governing laws of Hundi in Nepal:

- Muluki Criminal Code Act, 2017 section 125(A)

“Hundi related transactions” means transactions in which any amount or value is transferred from Nepal to abroad or from abroad to Nepal, or any amount or value is transferred or reconciled or payment is received, given or made by any person, equipment or any other means other than through a recognized organization or payment instrument as per the prevailing law.

- Money Laundering Prevention Act, 2011

- Organized Crime Act, 2013

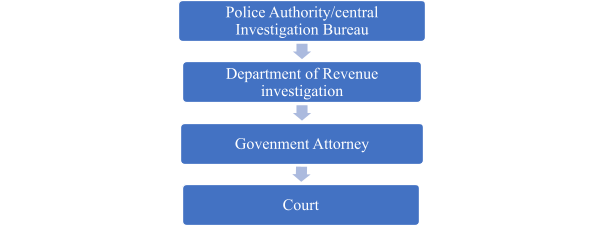

03. Governing Authorities:

The figure below outlines the authorities that may involve in Hundi

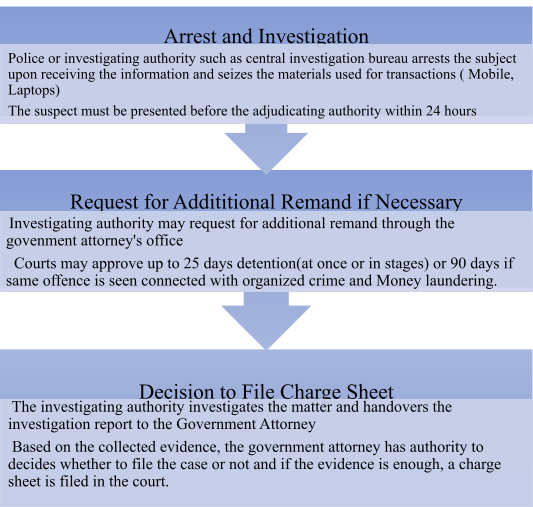

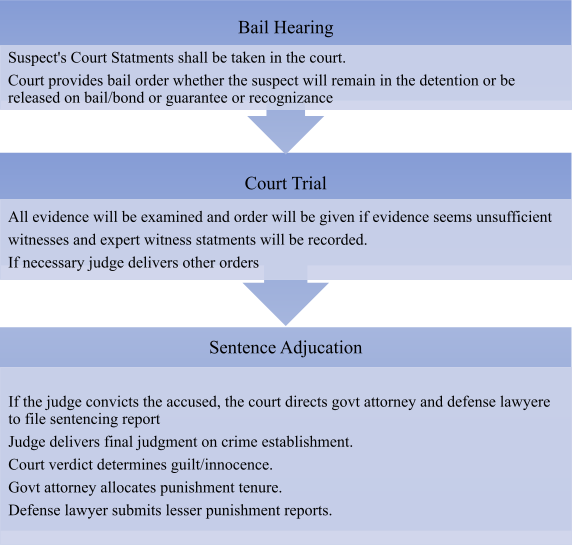

04. Case Process in the Court:

The figure below outlines the procedural stages for prosecuting Hundi offenses in Nepal

a. Pre-Trial Phase

b. Trial Phase

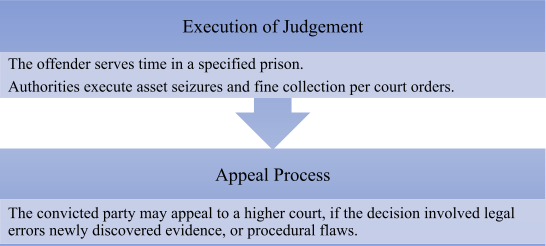

b. Post-Trial Phase

Note:

- One year or less punishment: Accused can appeal while staying out of prison by depositing RS.300 per day as prison fee.

- More than one year punishment: Accused must appeal from inside prison

- Appeal deadline passes: Punishment period Execution begins Court summons involved parties.

05. Timeline for Investigation decision:

- The investigation period may extend up to 25 days

- Court decisions in such cases may take 9-12 months.

06. Punishment for Practicing Hundi under Nepalese laws:

Foreign exchange business (like sending or receiving money between Nepal and other countries) is illegal unless conducted through an authroized bank (Nepal Rastra Bank) or payment service provider in accordance with the law. Section 125(A(2) suggests to keep proper records of transactions. If anyone breaks this rule, any money, items, or profits gained from the illegal transaction will be seized, and the offender can face up to one year in Jail.

In hundi crime mostly elements or hudi cant be proved by government attorneys and investigators also cannot show the linkage with evidences.

Note: while the Hundi system operated in a legal gray area in Nepal, it is now explicitly prohibited under Section 125-A of the Muluki Criminal code (General code), which criminalizes unauthorized foreign exchange transactions. Before the enactment of the general law, Hundi-related activities were regulated under the Foreign Exchange (Regulation)Act and the Nepal Rastra Bank Act, which provided some oversight but did not impose outright criminal penalties.

However, under the current legal framework, engaging in Hundi transactions constitutes a punishable offense. The law clearly mandates that all cross-border financial transactions must be conducted exclusively through authorized banking channels and licensed payment service providers.

7. Recent Cases of Hundi related Crimes in Nepal

In recent years, Nepal has seen a rise in informal Hundi transactions, facilitated by evolving technologies and regulatory gaps. While traditional Hundi networks continue to operate, digital platforms including international remittance apps, social media channels like TikTok and Facebook, and cryptocurrency exchanges such as Binance have expanded its reach. Many recent Hundi cases show connections to cryptocurrency trading schemes, highlighting how digital tools are being leveraged to bypass formal banking channels.

Let me know if you’d like to add jurisdiction-specific laws! Several Nepali citizens were arrested by police for their alleged involvement with the Hundi platform via through different applications and websites in internet world which was primarily used for trading USDT. Initially complaints were filed against them for theft, but investigations revealed their involvement in large-scale While the accused were first charged under theft laws, further investigation exposed their violations of foreign exchange regulations, leading to additional charges under the Nepal Rastra Bank (NRB) Act.

During investigations, if authorities uncover any criminal activity, they may connect it to related offenses such as hundi operations, cryptocurrency transactions, fraud schemes, organized crime, or money laundering, which helps escalate the gravity of the case and potential penalties.

The Kathmandu District attorney’s office has now pressed charges under section 125-A of the Muluki criminal code, which explicitly prohibits unauthorized foreign exchange transactions, including hundi. Authorities have also pressed additional charges under the NRB Act for financial violations. This case reflects Nepal’s stricter enforcement against illegal money transfer systems, especially those using cryptocurrency to bypass official banking channels.

8. Legal Alert: Hundi Transactions Being Misused for Fraudulent Employment Claims:

We are observing a concerning trend where Hundi agents are exploiting innocent recipients through fraudulent legal actions:

An agent transfers money through illegal hundi networks to a recipients personal account, the same agent files a case in Foreign Employment Department falsely claiming the funds where sent as payment as foreign employment fraud.

Innocent recipients, who believed the money was a remittance or personal transfer are suddenly accused of employment scams, facing investigations or penalties. This has led, victims to pay for settlements to avoid legal harassment. This is a predatory tactic to extort money. Never accept Hundi transfers, and consult a lawyer immediately if accused.

9. Conclusion

While Hundi operates in a legal gray area in Nepal—expressly prohibited under the Muluki Criminal code 2017. The rise of blockchain and digital assets demands regulatory adaptation. If at Lawin & Partners, we offer strategic counsel on Hundi-related matters, including:

- Compliance advisories for evolving financial regulations,

- Dispute resolution for cryptocurrencies and informal transactions,

- Defense representation in cases involving NRB violations.

As Nepal’s financial landscape transforms, our team stays at the forefront of regulatory shifts, ensuring robust protection for clients in this complex sector.

For proactive legal solutions in digital assets and cross-border finance, consult with Lawin and Partner’s Criminal Law experts today.

For quick legal assistance:

You can directly call to our legal expert: +9779841933745

Even can call or drop a text through What's app , Viber, Telegram and We Chat at the same number.

Also can do email on : [email protected]

Get in Touch with Our Legal Experts

Have a question or need legal assistance? Fill out our contact form and our team of experienced lawyers in Kathmandu, Nepal will get back to you promptly.

Please include your WhatsApp or Viber number in the phone section if you'd prefer a direct call from one of our legal professionals.

We are here to provide trusted legal support tailored to your needs.

Phone : +9779841933745, +9779841933745