Cryptocurrency Crime in Nepal and Court Process

Cryptocurrency Crime in Nepal and Court Process

This article describes cryptocurrency crime in Nepal and overall court process for this crime.

01. Background

Cryptocurrencies, virtual currencies, and e-money are digital cash transactions used in electronic platforms, mobile applications, and specialized websites, operating independently instead of formal banking institutions and financial technical systems. These digital transactions rely on blockchain technology and cryptographic security measures, enabling decentralized network of computers and often anonymous exchanges worldwide.

Digital Currencies has paved way for numerous digital currencies and trending platforms. Nepalese government prohibits the use, mining, storage and trading of cryptocurrencies under existing financial laws, classifying such activities as illegal.

This article informs you, why crypto currency, virtual currencies transaction is considered as crime in Nepal, laws and court process for cryptocurrencies or virtual currencies cases.

02. Cryptocurrencies/ Virtual Currencies under Nepalese Law

Muluki Criminal Code Act, 2017 Section 262 (A) describes crypto/ virtual currency:

Any information, code or code number token, cryptocurrency or similar virtual asset that is created or produced electronically by cryptography or other means and has significance or utility in commercial activities or that can be used to store or represent value or a unit or account.

03. Why Cryptocurrency/virtual Currency is Illegal in Nepal?

- Law Prohibits the use and transaction of virtual currency.

- Cryptocurrency is not legally recognized as money; therefore mining/purchase/sale is not legitimate in Nepal.

- Cryptocurrencies operates without banks or government oversight, making it hard to track and regulate and monetary control

- Risk of illegal activities- crypto could enable tax evasion, money laundering, and illegal transactions.

- Protection the Nepalese Rupee (NPR)- widespread crypto use might destabilize NPR by replacing it

- Preventing financial scams- many crypto schemes are fraudulent, risking public savings.

- No Legal Framework yet- Nepal lacks regulations to safely manage crypto

4. Governing Laws for Cryptocurrencies

Muluki Criminal Code Act, 2017

Muluki Criminal Code, Section 262 (A) has prohibited crypto currency/virtual currency as stating that “No one in Nepal shall produce, sell, trade, store, or transfer cryptocurrency or any virtual currencies for payments or business transactions, except for currency issued or recognized by Nepal Rastra Bank.

05. Governing Authorities

- Central Investigation Bureau (CIB)

- Police Authorities/Institution

- Nepal Rastra Bank (Central Bank of Nepal)

- Government Attorney Office

- District Courts

- Revenue Investigation Department

06. Cryptocurrency/Virtual Currency Related Laws

The legal consequences for cryptocurrency offenses depend on Laws under which chargesheets are filed. Each applicable law carries its own set of penalties, as detailed here:

| Act /Laws | Punishment |

|---|---|

| Muluki criminal code Act section 262 (A) |

|

| Foreign exchange (Regulation) Act, 2019 section 17 (1) |

|

| The Electronic Transaction Act, 2008 Section 47 |

|

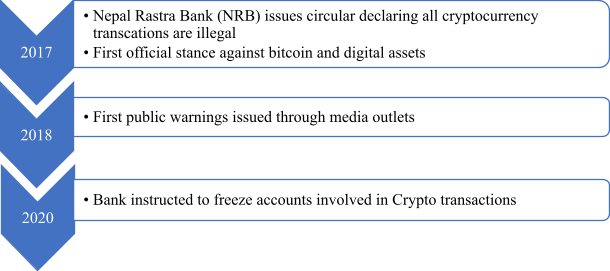

07. Notable Events: Timeline of Cryptocurrency Regulation in Nepal

08. Cryptocurrency Regulations: Nepal vs. Other Countries

India:

Cryptocurrency is legalized but heavily regulated. Taxation 30% tax on crypto profits and 1% TDS on transactions. Major Indian companies (e.g., Reliance, Tata) are exploring blockchain and digital assets.

UAE (Dubai & Abu Dhabi):

Licensed exchanges (e.g. Binance, Kraken) operate legally, strict KYC/AML compliance required.

Japan:

Recognizes Bitcoin as legal tender. Only licensed exchanges (e.g., BitFlyer) can operate.

USA:

Highly regulated (treated as securities in some cases). Taxable asset is under laws.

However China, Bangladesh and many other countries has banded and illegalized trading, mining and transaction of the cryptocurrencies.

09. Court Process for Cryptocurrencies (Virtual Currencies) Crimes in Nepal:

A. Pre- Trial Process:

Step 1: Arrest and Investigation

- Police or investigating authority such as central investigation bureau (CIB) arrests the subject upon receiving the information and seizes the materials used for transactions (mobile, Laptop, harddrive etc)

- The suspect must be presented before the adjudicating authority within 24 hours by investigating authority

Step 2: Remand/Remand Hearing and Pleading

- Investigating authority may request for additional remand through the government attorney’s office

- District Courts may approve up to 25 days detention (at once or in stages) or 90 days if same offence is seen connected with organized crime and Money laundering

B. Pre- Stage Process:

Step 3: Decision to file charge-sheet in the court.

- The investigating authority, investigates the matter and handovers the investigation report to the Government Attorney

- Based on the collected evidence, the government attorney has authority to decides whether to file the case or not and if the evidence is enough, a charge sheet is filed in the district courts.

- Government Attorney have right to decide and declare for suspect to file a chargesheet or not after finding out the grivaty of involvement.

- Charge-sheet will be registered in the court.

Step 4: Bail Hearing

- Suspects Court statements shall be taken by the court

- Pleading by the defense lawyers representing the suspects

- Court provides bail order whether the suspect will remain in the detention or be released on bail/bond or guarantee or recognizance.

Step 5: Evidence collection and examination

- All evidence will be examined and order will be given if evidence seems insufficient

- Witnesses and expert witness statements will be recorded

- If necessary judge delivers other required orders

Step 6: Verdict /Judgement determining Guilty or Innocent

- If the judge convicts accused, the court orders government attorney and defense lawyer to file sentencing reports.

- Court verdict determines suspects as crime guilty or innocence.

- Government attorney always demands maximum sentencing/ punishment in the report and submit to court.

- Defense lawyer demands lesser punishment sentencing reports and submit to court.

C. Post-Trial Process:

Step 7: Final Judgement/ Sentence Hearing

- Judge Declares the punishment based on the legal provisions.

- Final Verdict will be prepared

Step 8: Execution of Judgement

- Guilty shall be imprisoned

- Property forfeiture

- Fine amount/medical treatment deposit.

Note:

- One year or less punishment: Accused can appeal while staying out of prison by depositing RS.300 per day as prison fee.

- More than one year punishment: Accused must appeal from inside prison

- Appeal deadline passes: Punishment period Execution begins Court summons involved parties.

10. Recent Cases of Cryptocurrencies Crimes in Nepal

1.Family-Run Crypto Fraud & Tax Evasion (Rs. 376.4 Million)

A family was arrested for illegally trading cryptocurrencies (Bitcoin/USDT) via apps like e-Scroll and Nivansh, bypassing Nepal Rastra Bank (NRB) bans. Deposited Rs. 97.998 million in Nepali banks and engaged in unauthorized forex transactions. Sentenced to 3 years imprisonment under the Muluki Criminal Code (Kathmandu District Court).

2. Gang Bust (Rs. 3 Billion Crypto Trading)

A group, including a 23 Indian national, operated a crypto trading and betting from a rented house in Budhanilkantha, Kathmandu (February 2025). Case filed in Kathmandu District Court; investigation ongoing.

3.Student-Led Crypto Operations (Rs. 1.6 Million Monthly Turnover)

Young students facilitated 2,000+ transactions for 975 clients using banned virtual currencies. Highlighted the misuse of peer-to-peer (P2P) platforms for illegal forex dealings.

4. Recently 20 people were suspected in charge of cryptocurrency who were adult group of people using biance, cashflow other different apps and amount was transacted in USD where that particular amount was received and distributed to multiple group of people and these 20 suspects were investigated under Hundi, cryptocurrency and Fraud case.

11. Legal and Regulatory Challenges

Prior Nepal Rastriya Bank had issued a notice/directive and on that basis enforcement and investigation was done. In 2081 Magshir, Muluki Criminal Code was amended and mentions crypto offenses as criminal acts (not just regulatory breaches), with penalties like imprisonment and confiscation of properties.

Absence of specific and strong investigation mechanisms, laws, on digital currencies and blockchain cross border transaction also considered as mostly challenge to Nepal. Many fake citizenships are being made to create account in various digital currencies related applications.

Note: Cryptocurrency operates in a legal gray area in Nepal without specific laws and bylaws, General Law, Criminal Code mentions about the crime. Prior to these general laws, with the Nepal Rastra Bank (NRB) currently prohibiting its use under foreign exchange laws. Nepal Rastra Bank’s notice was executing the offence of virtual currency. However, the global rise of blockchain technology and digital assets makes regulatory evolution inevitable. At Lawin and partners, we provide strategic counsel on cryptocurrency-related matters, including compliance advisories, dispute resolution for crypto transactions, and representation in cases involving alleged NRB violations. As Nepal’s financial landscape adapts, our team stays ahead of emerging regulations to protect clients navigating this complex sector. For proactive legal solutions in the digital asset space, consult our experts today.

For quick legal assistance:

You can directly call to our legal expert: +9779841933745

Even can call or drop a text through What's app , Viber, Telegram and We Chat at the same number.

Also can do email on : [email protected]

Get in Touch with Our Legal Experts

Have a question or need legal assistance? Fill out our contact form and our team of experienced lawyers in Kathmandu, Nepal will get back to you promptly.

Please include your WhatsApp or Viber number in the phone section if you'd prefer a direct call from one of our legal professionals.

We are here to provide trusted legal support tailored to your needs.

Phone : +9779841933745, +9779841933745